IRS Announces 2025 Retirement Plan Limits: What You Need to Know About 401(k) and More

Table of Contents

- IRS Increases 401(k) Limit to ,000 for 2024, IRA Limit to ,000 ...

- 2024 Irs 401(K) Income Limits - Astra Candace

- Irs 401k Employer Match Limits 2025 - Jessa Kaycee

- The NEW 2025 Retirement Plan Contribution Limits! KEY Updates Inside ...

- 2024 Irs 401(K) Income Limits - Astra Candace

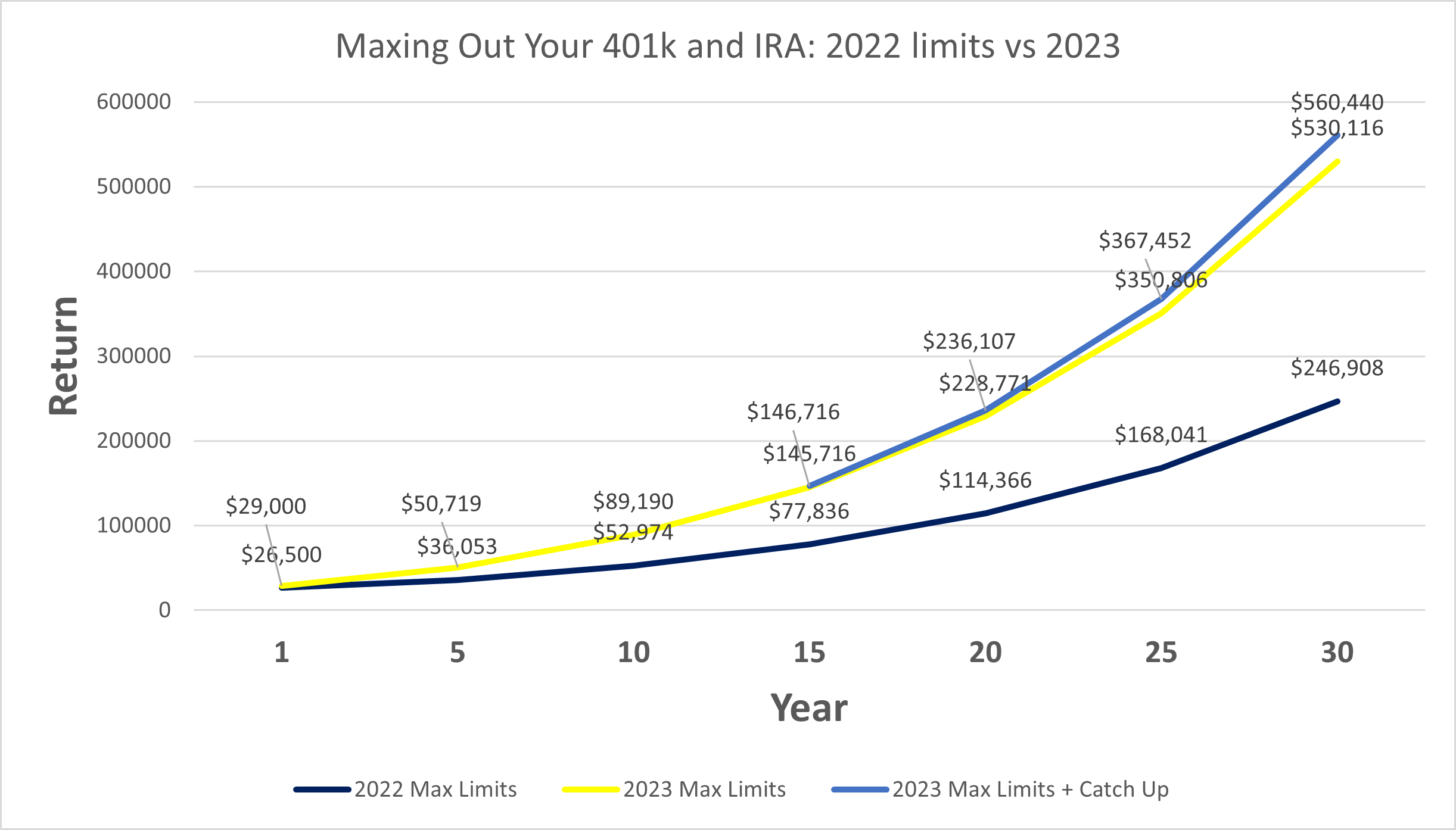

- New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket ...

- 2024 Irs 401k Limit - Devina Evangelina

- 2024 IRA Contribution And Income Limits: What Retirement Savers Need To ...

- IRS announces 401(k) catch-up contributions for 2025 – NBC Los Angeles

- It's Official: 401(k) Contribution Limits for 2025 Are Here

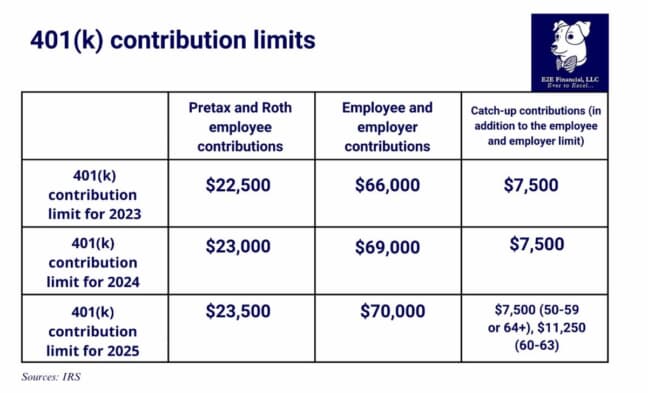

Increased Contribution Limits for 401(k) and Other Plans

Income Limits for IRA Contributions and Deductions

Other Key Limitations and Thresholds

Other notable changes and limitations for 2025 include: The annual limit on additions to a SEP-IRA or a solo 401(k) plan has increased to $66,000, up from $64,500 in 2024. The annual limit on defined benefit plan annual benefits has risen to $265,000, a significant increase from the 2024 limit of $255,000. The highly compensated employee (HCE) threshold has increased to $145,000, affecting the administration of certain retirement plans.

Conclusion and Planning Considerations

The IRS's release of the 2025 qualified retirement plan limitations provides valuable information for individuals and employers to plan and optimize their retirement savings strategies. It is essential to review and understand these changes, as they may impact contribution amounts, income limits, and overall retirement planning. As the new year approaches, consider the following: Review your current retirement plan contributions and adjust them according to the new limits. Consult with a financial advisor or tax professional to determine the best retirement savings strategy for your individual circumstances. Take advantage of catch-up contributions if you are aged 50 or over. Consider the impact of income limits on IRA contributions and deductions when planning your retirement savings. By staying informed about these updates and adjusting your retirement planning accordingly, you can make the most of the new limits and thresholds, ultimately securing a more comfortable and financially stable retirement.For more information on the 2025 qualified retirement plan limitations, visit the IRS website or consult with a qualified financial professional.