As the world of finance and commerce continues to evolve, governments around the globe are continually assessing and adjusting their tax laws to meet the changing needs of their economies and citizens. Australia, known for its robust and dynamic economy, is no exception. With the forthcoming 2025 Australian tax changes, individuals and businesses alike are wise to prepare themselves for what these adjustments may mean for their financial landscapes. In this article, we will delve into the anticipated changes, their implications, and how you can best position yourself and your business for the future.

Understanding the 2025 Australian Tax Changes

The Australian government has been working towards implementing a series of tax reforms aimed at stimulating economic growth, enhancing competitiveness, and ensuring fairness within the tax system. While the specifics can vary and are subject to parliamentary approval, several key areas of focus have been identified:

-

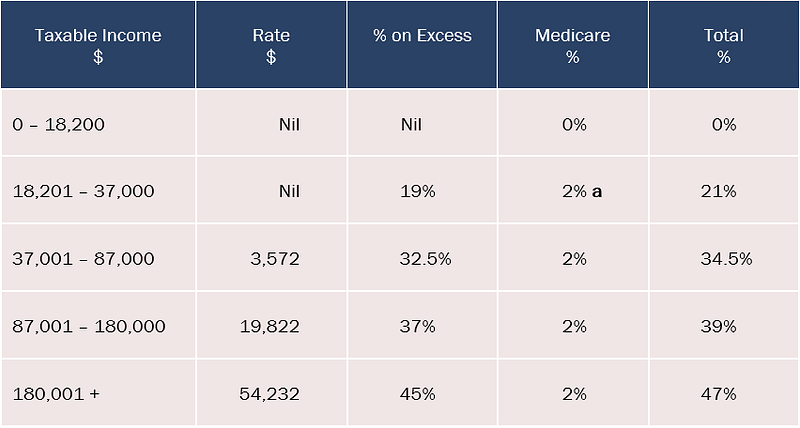

Personal Income Tax: There may be adjustments to tax brackets and rates to keep pace with inflation and ensure that the tax system remains progressive and fair.

-

Corporate Tax Rates: The government has considered reducing corporate tax rates to make Australian businesses more competitive on the global stage, potentially boosting investment and job creation.

-

Superannuation: Changes to superannuation rules could affect how individuals save for retirement, including contribution limits and pension drawdown requirements.

-

Small Business Tax Concessions: Enhanced tax concessions for small businesses, such as simplified depreciation rules and reduced payroll tax, could be on the horizon to support entrepreneurship and small business growth.

Implications for Individuals

For individuals, the 2025 Australian tax changes could mean several things:

-

Tax Relief: Lower tax rates or adjusted tax brackets could result in higher take-home pay, allowing for greater disposable income.

-

Retirement Savings: Any changes to superannuation laws could impact retirement planning, necessitating a review of personal superannuation strategies.

-

Investment Decisions: Tax changes can influence investment choices, such as the attractiveness of certain types of investments (e.g., property, shares) due to their tax treatment.

Implications for Businesses

For businesses, especially small and medium-sized enterprises (SMEs), the changes could be significant:

-

Competitiveness: A reduced corporate tax rate could enhance the competitiveness of Australian businesses in the global market.

-

Investment and Growth: More favorable tax conditions could encourage investment, leading to business expansion and job creation.

-

Compliance: Businesses will need to ensure they understand and comply with any new tax laws and regulations, which could involve updating accounting systems and processes.

Preparing for the Changes

Given the potential impact of the 2025 Australian tax changes, it's essential for both individuals and businesses to be proactive:

-

Stay Informed: Keep up-to-date with the latest announcements and legislative changes.

-

Consult Professionals: Seek advice from tax professionals or financial advisors to understand how the changes will affect your specific situation.

-

Review and Adjust: Be prepared to review and potentially adjust your financial plans, investment strategies, and business operations in response to the tax reforms.

In conclusion, the 2025 Australian tax changes are poised to bring about significant shifts in the financial landscape for individuals and businesses. By understanding these changes and planning accordingly, you can navigate the future of taxation with confidence, leveraging the opportunities that these reforms present to secure your financial future. Whether you're an individual looking to maximize your savings or a business aiming to thrive in a competitive market, being informed and prepared is key to success in the evolving tax environment.